Navigating the Age of Agility in APAC: The Post-Sale Frontier is Real

Editor's Note: This is the final post in a five-part series that discusses key trends in tech marketing. It is based on the APAC edition of the Age of Agility, a research report that LinkedIn produced after conducting one of the world’s largest research surveys of B2B technology buying and decision-making. Country reports for Australia & New Zealand, India and Singapore are also available now.

As tech marketers, we spend a lot of time focusing on before-the-sale marketing: building awareness, nurturing consideration, generating leads. And when a marketing lead converts into actual sales, we pop a virtual bottle of champagne and move on... But what about after the sale?

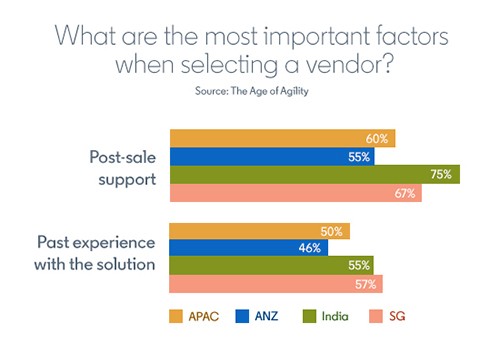

Post-sale support consistently ranks among the top three factors that decision-makers prioritise when choosing a vendor (60% in APAC, 68% in ANZ, 75% in India and 67% in Singapore).

This tells us that buyers are investing in an outcome, not a product. They expect their vendors to support them as they work to turn their technology investment into desired business results. For tech marketers, this has important implications when it comes to (1) retaining existing customers and (2) winning new customers.

To retain existing customers, remember that around half of all tech buyers (50% in APAC, 46% in ANZ, 55% in India and 57% in Singapore) take into account past experience with a solution when choosing a vendor.

This means that stronger relationships can lead to increased business opportunities.

As tech marketers, we can leverage Account-Based Marketing (ABM) strategies and work closely with sales, customer experience and other customer-facing functions to find out where existing customers feel our brand excels and where it may fall short of their expectations. These insights can form the basis for targeted messaging and action plans to elevate positive sentiments and address any less-than-positive ones.

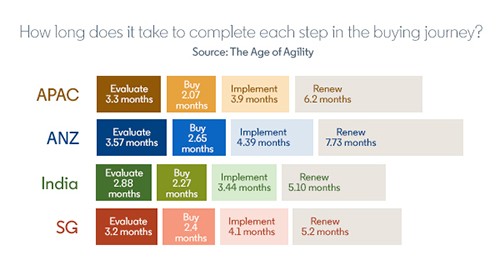

Similarly, when it comes to wooing new customers, we see an opportunity for tech marketers to focus on potential pain points like technology adoption timeframes, which can take nearly a year in enterprise companies across APAC.

Many technology solutions involve lengthy adoption periods, with implementation and renewals taking anything from 8.5 months in India to 12.12 months in ANZ. This can be a bugbear for potential customers as it impacts time-to-value, particularly for subscription-based solutions.

With metrics like net-dollar retention coming under greater scrutiny, vendors that show they are willing to work together with potential buyers to plan ahead for successful implementation and adoption are likely to stand out from the competition. As tech marketers, we can make sure that post-sale support shines through in our messaging but we can also do more.

To truly seize the post-sale frontier, sales, marketing and other functions like customer experience need to work as one. Internal alignment and cross-functional collaboration will be a crucial piece of the puzzle for brands to increase customer value and boost retention rates.

For more research insights into the B2B technology buying and decision-making process in APAC, get your copy of the full report:

- The Age of Agility: APAC Edition

- The Age of Agility: Australia & New Zealand Edition

- The Age of Agility: India Edition

- The Age of Agility: Singapore Edition

For more APAC tech marketing insights, subscribe to the LinkedIn Marketing Solutions Blog.

* This article was originally published here

Comments

Post a Comment